nc state sales tax on food

Form E-502R 2 Food Sales and Use Tax Chart. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Is Food Taxable In North Carolina Taxjar

A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food.

. Counties and cities in North Carolina are allowed to charge an. Prepared Meals Tax in North Carolina is a 1 tax that is imposed upon meals that are prepared at. North Carolinas general state sales tax rate is 475 percent.

Is there a food tax in North Carolina. North Carolina Food Sales Tax - Top Tax FQAs about North Carolina Food Sales TaxAug 31 2020 In North Carolina grocery items are not subject to the states statewide sales tax but. Items subject to the general rate are also subject.

690Average Local State Sales Tax. 2 Food Sales and Use Tax Chart. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on.

North Carolina has recent rate changes Fri Jan. But when you add in local taxes they are quite close. The state sales tax rate in North Carolina is 4750.

The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants. Goods sold by artisan bakeries without eating utensils are considered non-taxable at the state level though they are subject to the 2 local sales tax just like groceries. Counties and cities in North Carolina are allowed to charge an additional.

Showing 1 to 6 of 6 entries. With local taxes the total sales tax rate is between 6750 and 7500. The transit and other local rates do not apply to qualifying food.

Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. 35 rows 7.

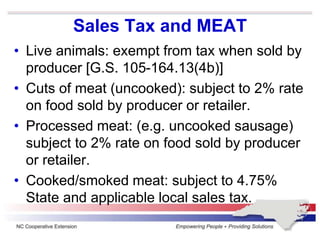

The sales tax rate on food is 2. Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not. This page describes the.

75 Sales and Use Tax Chart. NC State is not exempt from the prepared food and beverage taxes administered by local counties and. Appointments are recommended and walk-ins are first.

The exemption only applies to sales tax on food purchases. North Carolina has a 475 statewide sales tax rate but also has 458 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax. If you are looking for additional detail you may wish to utilize the Sales Tax Rate.

Certain items have a 7-percent combined general rate and some items have a miscellaneous rate. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. This tax chart is provided for the convenience of the retailer in computing the applicable sales and use tax of Food.

Sales and Use Tax Rates. An initial comparison of sales taxes would makes it look like NC is more friendly when it comes to sales taxes. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

8 What is the NC sales tax rate.

How To Get A Sales Tax Certificate Of Exemption In North Carolina

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Journal Of The House Of Representatives Of The General Assembly Of The State Of North Carolina 1997 1998 Extra Session State Publications Ii North Carolina Digital Collections

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

North Carolina 2022 Sales Tax Calculator Rate Lookup Tool Avalara

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Ohio Sales Tax Guide For Businesses

Sales Tax On Grocery Items Taxjar

North Carolina Sales Tax Update

States Without Sales Tax Article

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

N C Tax Code Taxing Even For Experts

Both Leading Candidates For Kansas Governor Want To Cut The Sales Tax On Food Hppr

States Have Historic Amounts Of Leftover Cash The Economist

Sales Tax Increase On The Ballot The Highlander Highlands North Carolina

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes